Streamline your share registry management by outsourcing to an experienced and affordable team.

Simply enquire now and we will get in touch.

Services Overview

We have positioned ourselves within the market as an affordable alternative to expensive share registry management for private and public companies. We use technology at the forefront of our service, coupled with industry leading support from an experienced compliance team.We are also highly knowledgeable on the latest equity crowdfunding legislation and shareholder registry requirements that come with this new piece of legislation.

✔ Comprehensive Management

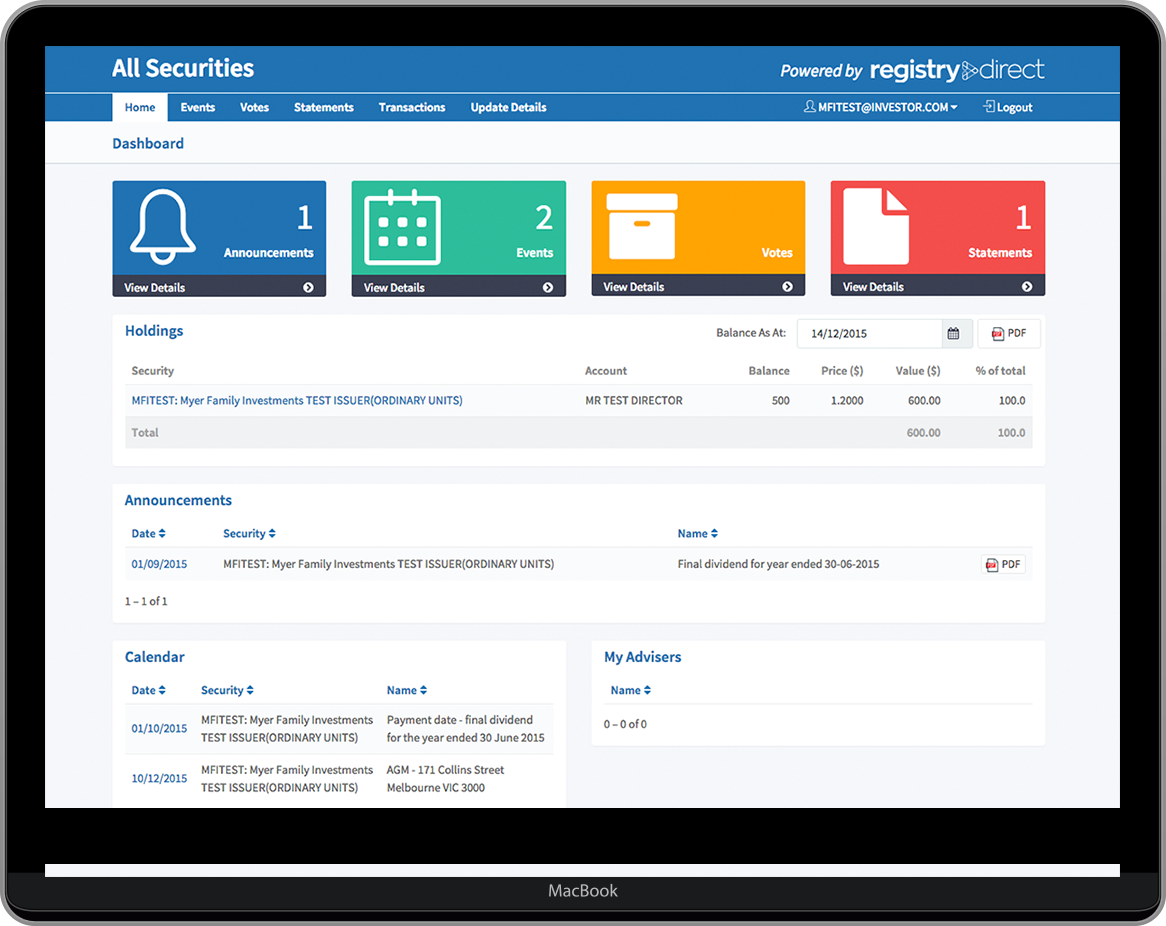

Complete management of non-listed company registries including dividend and distribution payments, meeting services, print and mail services, corporate actions and more. We utilise Registry Direct registry software to provide your company with enhanced functionality and streamlined online services.

![]()

✔ Compliance Covered

Automatic reminders and our direct connection to ASIC means that you can meet your obligations in minutes, never missing a deadline.

✔ Easy Establishment

Simple set-up of new registries and employee schemes, including transitions of existing schemes, fully supported by our customer service team.

✔ Scalable and Flexible

Your registry platform can be customised to your needs, allowing you to control your costs and allocation of work.

✔ Better Communication

Fast and direct two-way communication with security holders through our portal, events calendar, email and even snail mail.

✔ Own Your Channel

You own your customers' brand experience, through a branded platform, created for you by our system.

✔ Full Shareholder Support

Your company portal means shareholders can manage their holdings online, and our customer service team takes care of any security holder phone enquiries, meaning that you don't have to.

✔ In Safe Hands

Our technology protects your data with bank-level 256-bit encryption and maintaining the privacy of users, in accordance with Australian Privacy Principles, Corporations Act 2001 and Settlement Operating Rules.

Our fees are incredibly affordable and we are able to scale our services to meet your individual needs. Please get in touch to discuss our services. You can contact us on contact@abnaustralia.com.au, call us on 1300 226 226, or use the enquire now form.

Equity Crowdfunding

We are experienced and knowledgeable regarding the latest crowdfunding legislation in Australia, and thus well positioned to look after your share registry needs efficiently and compliantly. We are also able to provide our share registry services at affordable prices - contact us for more information.

Overview of Equity Crowd-Sourced Funding Legislation

We recently wrote about the latest crowd-sourced funding legislation changes which extends the crowdfunding provisions to private companies in Australia (previously you had to conver to a public company).

Equity-sourced crowdfunding is a new type of fundraising, typically online, that allows a large number of individuals (or the ‘crowd’ at large) to make small financial contributions towards a company in exchange for an equity stake in the company.

In Australia, the CSF legislation took effect on 29 September 2017, but only for unlisted public companies that wished to raise up to $5 million in 12 months through an AFS licensed intermediary who is authorised to provide CSF services.

Responding to concerns regarding the inefficiencies in the new CSF regime from both early stage companies and equity crowdfunding platforms, the Corporations Amendment (Crowd-sourced funding for proprietary companies) Bill 2017 (Cth) was passed by the Senate on 12 September 2018 and will come into effect 28 days after receiving royal assent, extending equity crowdfunding to proprietary companies.

This is great news for early stage companies as this form of capital is now more readily accessible with less regulatory red-tape slowing down the process.

Impact of shareholders and share registry

While the new legislation does require companies to include details of CSF shareholders on the company register, these will not count towards the 50 shareholder cap that applies to proprietary companies. This exemption continues to apply even if shares are transferred to another shareholder later, so long as the shares were originally issued through a CSF offer and that the company’s shares have not been traded on financial markets (in Australia or otherwise).

Additionally, proprietary companies utilising equity crowdfunding will be exempt from Chapter 6 of the Corporations Act 2001 (Cth) which deals with takeover rules that usually apply to companies with over 50 shareholders. This exemption means that proprietary companies raising capital through CSF will not have to navigate the complex and onerous rules in Chapter 6, despite having a diverse share register after raising funds through equity crowdfunding. This is a positive given that many early-stage companies will be aiming to position themselves for a sale in the future.

Fee Schedule

We aim to keep our prices affordable, leveraging the latest technology to offer a streamlined solution with full support. Pricing plans for unlisted companies of all sizes are available, with the flexibility to upgrade as you grow. The fees include the provision of software and shareholder portals.Initial Fees (Excluding GST)

Setup Costs: price available on request

Ongoing Fees (excluding GST)

Up to ten shareholders: price available on request

Above 10 shareholders: price available on request

Additional non standard support billed at our hourly rates

Our Credentials

Our staff and resident directors are highly experienced individuals with qualifications and expertise across a range of different business activities. Our staff members are members of the followg professional bodies:

Our Promise

Our team has been providing affordable business registration and corporate services since 1976. Our longevity reflects our reputation for the best customer service in the business, underpinned by our commitment to effective documentation and attention to detail.Our goal is to partner with companies who understand the value of an informed registry provider, so please get in touch to discuss your needs.